What you’ll find in today’s edition:

- 🇸🇬 Singapore Expat Money Report: How 75 expats in Singapore from 22 countries approach their savings, investing, asset allocation, challenges, and personal tip

- 🎩 HNWI Americans renouncing citizenship

- 🔥 FIRE book pick, couples money therapy, Spain digital nomad visa

Let’s jump in!

🇸🇬 Singapore Expat Money Report

1. Expat Profile

Country of Origin

To kick thing off, I’m blown away by how the Singapore expat community looks like a mini-United Nations. Our cohort of 75 expats moved to Singapore from 22 countries. Wow.

The top 5 countries represented 2/3 of the cohort: United States (24%), India (14%), Indonesia (11%), Malaysia (10%), United Kingdom (8%)

Time Spent in Singapore

Out of this group, 86% expats have lived in Singapore for >1 year. Yet surprisingly nearly 35% have called the little red dot home for over 5 years.

- I take this data with a grain of salt given the small sample size, but I didn’t expect there to be so many long-term stayers.

- My take on “why”: Many expats initially believe (genuinely) that they’ll stay for <2 years, but decide to extend for work, family, and quality of life reasons.

Age

Our cohort grew up with Backstreet Boys and Beyoncé, aka millennial at its core. >90% of responding expats fell between the ages of 25-44, while 2/3 were in the 25-34 range.

Employment

Fortunately, nearly all (93%) respondents are gainfully employed by a company and not caught with their pants down from tech layoffs.

However, the entrepreneurship corner is awkwardly empty. Only 3 expats describing themselves as self-employed.

Education

This group was more academically dominant than a bunch of Ravenclaws. 99% had a college degree and 43% even had a masters degree.

Financial Literacy

Similar to how everyone loves to call themselves “middle class”, we got a majority (60%) of respondents rated themselves as “Intermediate” in their personal financial literacy. Out of the remaining folks, more rated themselves as “Advanced” (23%) vs “Beginner” (18%).

Now we’re getting to the real juicy stuff!

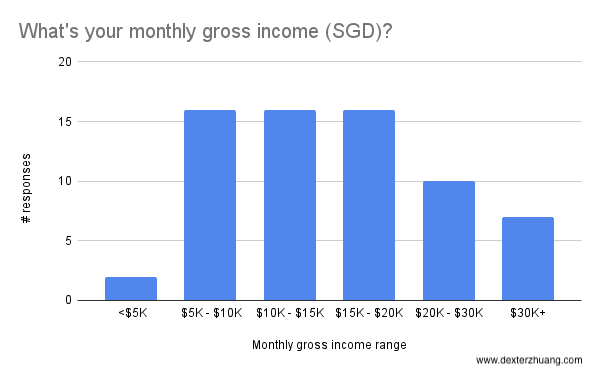

Our fellow expats are a high-earning bunch (no surprise):

- ~72% of respondents earned a monthly gross income that fell within $5k-$20k

- The group is more skewed towards higher income levels, i.e. ~10% earned over $30k / month vs only ~3% earned under $5k / month

3. Savings, Investments, Expenses

Participating expats allocated roughly similar % of their monthly income to savings, investments, and expenses irrespective of how much dough they brought in:

- ~25% savings

- ~25% investments

- ~50% expenses

TBH I didn’t expect these results. I personally expected that the higher the income, the higher the savings/investment rate.

However, like every French person’s World Cup finals prediction, I was wrong.

4. Asset Allocation

Here’s where things get even more juicy.

Key insights from our cohort:

- Company equity & real estate were prized by higher income earners: Expats earning >$15k / month hold ~20-100% more assets in Company Equity and Real Estate — vs expats earning <$15k / month. The former also held ~10-30% less of their assets in Stock than the latter.

- Crypto holdings skewed towards the extremes: Crypto made up ~15-20% of assets for expats with >$30k and <$10k of monthly gross income, but <10% of assets for folks earning between $10k-$30k

- Cash is king on the lower end: Expats with <$10k monthly gross income kept more of their assets in cash (>30%) vs higher income expats (<20%)

- Alternatives still had limited adoption, making up ~5% of assets across income levels

5. Challenges

Top 5 personal finance challenges for expats:

Market volatility / inflation (~16%)

- “The bear market, inflation and crypto winter!! Sig[nificant] losses [in] stocks and crypto !!”

- “Investment climate taking a downturn”

- “Recession”

- “Volatile market”

Financial planning / education (~14%)

- “Not sure what's the best strategy/timing for me; had really bad experience with financial advisors, don't really trust the new robo advisors”

- “Understanding what to do in Singapore, SRS account for example, what do I not know about that I should know about”

- “Self control, lack of education, not enough easy 101 content and information, can’t be bothered to maximise savings”

- “Better management, long term planning”

Investing / asset allocation (~14%)

- “Balancing short term and long term investment ratio”

- “Too tech heavy in stocks - needs more balance, Passive income for parents”

- “possibly over reliance on ETFs”

- “Not knowing when, how, and where to invest”

- “Knowing where to invest in this environment”

Access / eligibility / UX (~14%)

- “Access to exchanges / investment products (local banks, crypto exchanges have KYC restrictions on doing transactions with Ukrainian nationals :'( had a few accounts closed in the last 12 months )”

- “I want to get access to more sophisticated asset classes and private deals”

- “Lack of financial instruments available to US citizens”

- “Limited resources for expats in Singapore. Using Robinhood for stocks, coinbase for cryptos, and put money to Roth IRA every month.”

- “Finding opportunities and easy to use platform”

- “Lack of one-stop portfolio that invests in alternatives and modern investment modes (nft, crypto). The available ones in the market are traditionally stocks, bonds, ETFs”

Increasing savings (~11%)

- “Saving for downpayment and saving for retirement”

- “Saving up enough for a downpayment among rising rent”

- “not putting enough into my retirement”

- “Being able to save/invest enough, given high cost of living in Singapore”

6. Tips and Advice

Top 5 personal finance tips shared by expats:

Invest in tax-advantaged accounts (~13%)

- "Invest in SRS if you're not doing so already

- “Tax reliefs, SRS, 0% capital gains tax”

- “Open a Roth IRA and max it out if you’re not a PR”

Beware the hedonic treadmill (~11%)

- “Take your time to figure out where to shop and eat. The "Expat Life" only lasts for so long before it dries you bank account.”

- “Beware the hedonic treadmill, make use of the tax benefits and invest more”

- “Live in older HDBS, furnish your house second hand”

- “Stop buying things you cannot afford. Can buy it doesnt mean you can afford it”

Seek professional help (~10%)

- “Get a tax planner”

- “For those who do not know how to invest, feel free to use wealth manager or finance aggregator services like Finexis”

Learn to invest early (~10%)

- “Depending on the context, invest as early as possible. Employ barbell strategy. All in is a fools game. Check out ergodicity and it effect on systems where you can lose.”

- “Invest aggressively when in 20s and 30s”

- ”Learn to invest for growth or stability. Decide”

Plan for volatility / diversify (~8%)

- “Be prepared for up and down housing market”

- “Diversify - allocate based on your risk appetite”

- “Have a diversified portfolio and get multiple income streams”

Honorable mentions:

- Plan ESOP taxes: “Beware the deemed exercise rule if you have ESOP”

- Plan / optimize taxes:“Get PR to get discounts. If American, no additional absd [Additional Buyer’s Stamp Duty]”

- Dollar cost average: “Use a robo like Syfe to dollar cost average and gradually build wealth”

- Reduce fees: “Use crypto to send money between countries - it's actually cheaper”

- Avoid professional help: “Don't go with expensive wine-and-dine wealth manager”

- Avoid crypto: “Crypto is gambling”

- Avoid vices: “Don't drink or smoke, it’ll save you thousands”

🎩 Americans Renouncing Citizenship on the Rise

More HNWI Americans renounced their citizenships in 2022 by Q3 than all of 2021.

My take on why: Financial, tax, and business reasons. Just in the past year alone, I’ve spoken with several American expats who considered giving up their citizenship for tax reasons.

For the non-Americans: the US is one of two countries in the world that taxes its citizens no matter where they live (Eritrea is the other). Count your blessings that you don’t have to deal with our IRS.

I haven’t considered renouncing myself because of family, location optionality, and lack of business needs — but find it fascinating to understand peoples' reasons.

🧠 Inspiring Bites

📕 Read: Buy This Not That by Sam Dogen was one of my favorite reads in 2022. I’ve learned practical frameworks over the years from Sam, a former Goldman Sachs banker who retired at age 34 and OG FIRE blogger.

📺 Watch: Money is one of the top reasons why couples divorce. I loved this recent I Will Teach You to be Rich episode, where Nate and Serena are engaged and talk on camera about their awkward dynamics around splitting rent when one makes twice as much as the other.

📰 Follow: Spain is planning to launch its Digital Nomad Visa in January 2023, which would permit foreign citizens to live in Spain while working remotely for foreign companies.